Building a Branded Credit Card Fintech

The creation of a credit card fintech involves various regulatory, operational, and technological aspects. Let’s explore the main elements required to build this type of business in Brazil.

Licensing and Regulation

Registration with Card Networks

To issue credit cards, it is necessary to obtain licensing from card networks (such as Visa, Mastercard, Elo). The process includes:

- Payment of initial licensing fees ranging from $50,000 to $500,000, depending on the network

- Proof of financial and operational capability

- Compliance with PCI-DSS security standards

- Implementation of anti-fraud processes

Central Bank Regulation

The fintech must fall into one of the following categories:

- Payment Institution (IP)

- Direct Credit Company (SCD)

- Peer-to-Peer Lending Company (SEP)

Operational Structure

Card Processor

It is essential to hire a processor responsible for:

- Transaction authorization

- Payment processing

- Invoice generation

- Limit control

- Fraud management

Funding Sources

Credit resources can come from:

- Own capital

- Investment funds (FIDCs)

- Partnerships with banks

- Receivables securitization

Financial Flow

Transaction Revenue

- The cardholder makes a purchase.

- The merchant receives payment on average in D+30.

- The fintech collects revenue from the transaction:

- MDR (Merchant Discount Rate): 2–5% of the transaction value

- Interchange Fee: 1–2% (passed on to the card network)

- Spread: The margin retained by the fintech

Operating Costs

- Issuance of physical cards: R$ 5–15 per card

- System maintenance: R$ 50,000–200,000 per month

- Processing: R$ 0.50–2.00 per transaction

- Customer service: R$ 5–15 per interaction

- Credit analysis: R$ 2–10 per analysis

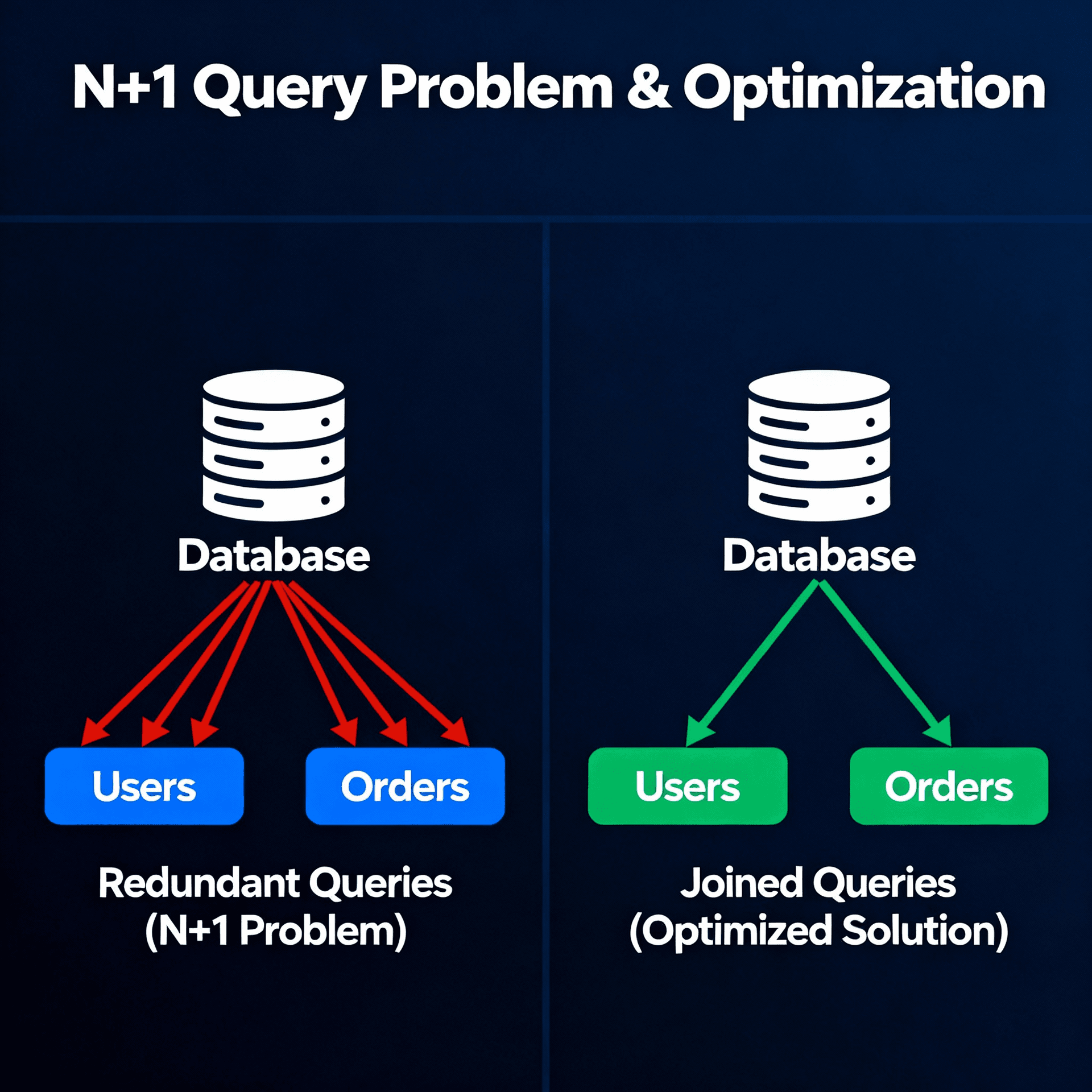

Required Technology

Core Systems

- Banking core

- Credit engine

- Anti-fraud system

- API integration with card networks

- Mobile app and internet banking

- CRM and collection system

Integrations

- Credit bureaus

- Card processors

- Card networks

- Payment gateways

- KYC (Know Your Customer) services

Challenges and Considerations

Risk Management

- Robust credit analysis

- Fraud monitoring

- Provision for bad debt

- Working capital management

Market Differentiation

- User experience

- Rewards program

- Competitive credit limits

- Attractive rates and fees

Conclusion

Building a credit card fintech requires significant investment in infrastructure, technology, and working capital. Success depends on efficient risk management and the ability to offer a differentiated value proposition to customers.

It is crucial to have an experienced team in:

- Credit risk management

- Regulatory compliance

- Product development

- Technology and security

- Financial operations