The Phychology of Money

1. The Psychology of Money

- Financial success is more about behavior than intelligence

- Our experiences shape our approach to money

- Be careful who you praise, admire, or look down upon

2. Wealth and Rich

- Wealth is hidden; it's income not spent

- Rich is current income; wealth is financial options

- The highest form of wealth is the ability to wake up and say, "I can do whatever I want today"

3. Savings and Frugality

- Savings rate matters more than investment returns

- Humility can increase your savings rate

- Save without a specific reason; it hedges against life's surprises

4. Investing Principles

- Compounding is powerful; time is the most important factor

- Be reasonable rather than purely rational

- Have room for error in your financial plan

- Focus on your own financial game, not others'

5. Risk and Luck

- Luck and risk are siblings; both impact financial outcomes

- It's hard to recognize the role of luck in success

- Plan on your plan not going according to plan

6. Optimism vs. Pessimism

- Optimism is a belief that odds of a good outcome are in your favor over time

- Pessimism sounds smarter and more plausible than optimism

- Progress happens too slowly to notice; setbacks happen too quickly to ignore

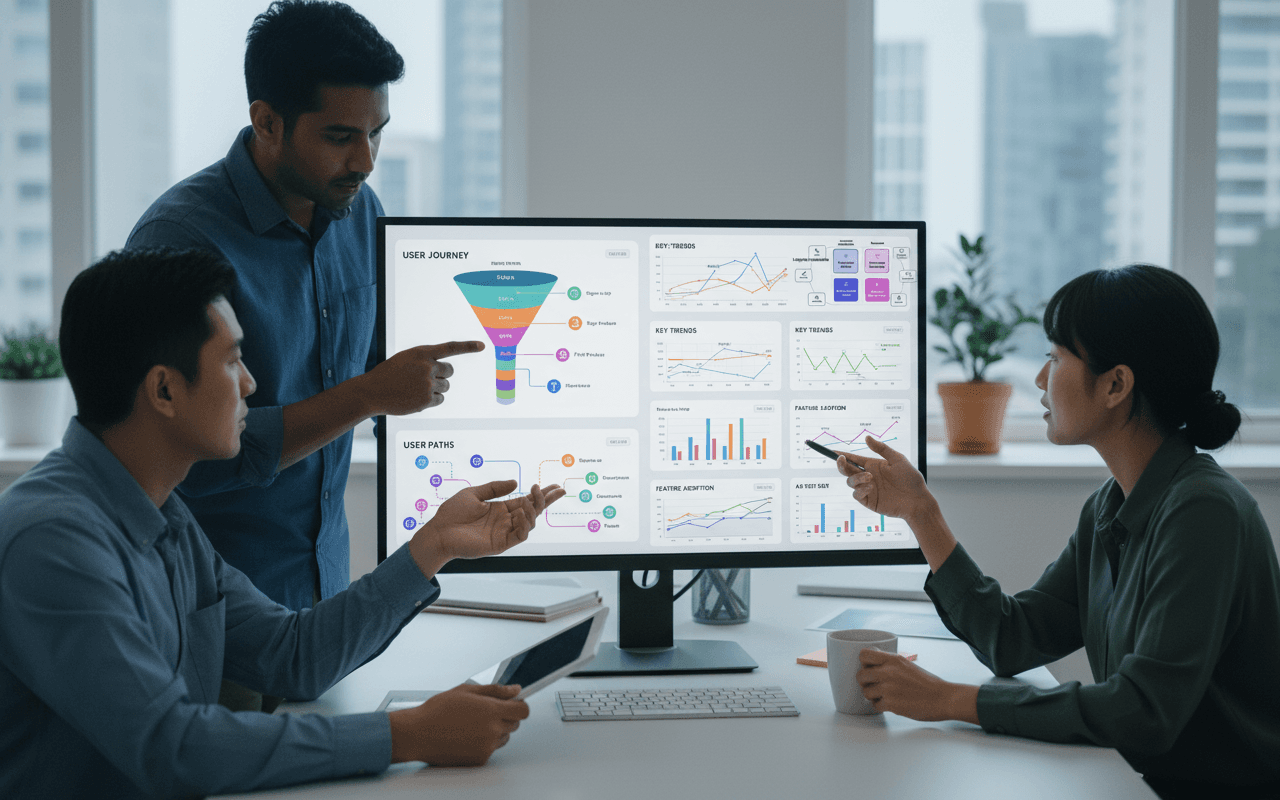

7. Financial Independence

- Use money to gain control over your time

- Independence removes social pressure and provides peace of mind

- Define the cost of success and be willing to pay it

8. Lifestyle and Happiness

- Happiness is relative to your own expectations

- Respect for the mess: there's no single right answer in finance

- Be nicer and less flashy; kindness and humility earn more respect than possessions

9. Historical Context

- Post-WWII economic boom shaped many financial expectations

- Economic shifts have led to increased inequality

- Understanding history helps contextualize current financial trends

10. Personal Finance Tips

- Manage money in a way that helps you sleep at night

- Increase your time horizon to do better as an investor

- Accept that many investments won't work out; focus on your full portfolio

- Avoid extreme financial decisions

- Define your own financial game and don't be influenced by others playing a different game